What does the future hold for Asia equities?

Investors face tailwinds and headwinds amid China's easing of its zero-Covid policy

According to the International Monetary Fund, China's zero-Covid policy, related lockdowns, alongside a deepening turmoil in the real estate sector, has led to an uncharacteristic and sharp slowdown in growth that in turn has led to a weakening momentum in connected economies.

But with China beginning to relax some of its Covid policies in the wake of mass protests, what will this mean for investors in Asia?

Also, where certain economies in Asia may have been previously overlooked and remained in the shadow of China, what opportunities are they presenting to investors?

This report is worth 30 minutes of CPD.

Advisers back Asia equities for good portfolio diversification

Advisers say that investing in Asia is a good way to achieve diversification in a portfolio, according to the latest FTAdviser poll.

The poll asked advisers whether they agree or disagree with the following statement: "Amid the current market turbulence, investing in Asia can act as a suitable diversifier for an investment portfolio."

The majority of advisers (90.9 per cent) agreed with the statement.

According to Mike Shiao, chief investment officer – Asia ex-Japan at Invesco, the unique economic dynamics of the region as well as the attractive valuations of Asia ex-Japan equities can provide global investors with good opportunities for diversification.

This is because the reopening of China can benefit the country’s domestic market and be an extra driver for Asia’s overall growth.

A rebound in China’s pent up domestic demand is also expected to result in a strong boom in trade, exports, and growth in neighbouring Asian countries.

Meanwhile, other regions such as India, Taiwan and Korea have strong growth prospects.

India is one of the fastest growing economies.

And despite the cyclical slowdown of the technology sector, which Shiao says is a short-term phenomenon, both Taiwan and Korea’s economies remain very competitive in the tech sector.

With zero-Covid relaxed, what is in store for Asia equity investors?

In its economic outlook for Asia and Pacific, released in October, the IMF cited three “formidable” headwinds faced by the region, one being China’s zero-Covid policy.

“[The] policy and the related lockdowns, which, coupled with a deepening turmoil in the real estate sector, has led to an uncharacteristic and sharp slowdown in growth, that in turn is weakening momentum in connected economies,” the IMF said.

With China having since announced relaxations to zero-Covid restrictions, what could this mean for Asia equity investors?

The relaxation process may not be smooth, but the direction is clearly towards reopening, which should positively impact China’s domestic economy, says Jian Shi Cortesi, GAM investment director.

“We have seen in the past year that almost every country experienced economic rebound when the country exited Covid. This should also be the case for China," Cortesi added.

“Given the huge economic size of China and its strong trade ties with the rest of Asia, a rebound in China’s economy will be positive to other Asian countries. This will be particularly helpful when global demand is weakening. We believe China’s Covid reopening will be a strong catalyst for the region next year.”

China has become more and more important for regional growth in recent decades

Peter Monson, co-portfolio manager of the Nikko AM Asia ex-Japan Fund, agrees that an easing of China’s zero-Covid policy should significantly improve prospects within China and for the broader Asia region, but he also notes it is unlikely to be smooth.

“Our emphasis is on fundamental change and the prospect for undervalued sustainable returns. China has become more and more important for regional growth in recent decades at the expense of EU and US demand,” he adds.

“Covid policy easing together with targeted stimulus should provide some growth support around the region, when the EU and US are likely to see slowing growth as a result of severe monetary tightening.”

Assuming zero-Covid can be exited effectively, John Leiper, chief investment officer at Titan Asset Management, likewise, forecasts a “meaningful” boost to economic growth.

Leiper says: “China is also well placed to stimulate the economy, given its differentiated approach to doing so previously, in terms of monetary and fiscal policy. We’ve seen signs of this [in November] with Chinese lenders set to pump over $160bn (£129bn) of credit into property development companies.”

When the US tightens, it is difficult for the rest of the world not to tighten

While the region may find some policy and growth support from China, Monson at Nikko adds: “We are still subject, to varying degrees, to further tightening of global financial conditions.

“This creates challenges for some, and means we are likely to find more resilient investment ideas in domestic demand-oriented segments, or those benefiting from shifts in the global capital expenditure cycles, towards both energy transition and supply chain security.”

So despite zero-Covid restrictions being relaxed, challenges remain for Asia equity investors.

US concerns

The first and foremost concern is still US monetary tightening and the US dollar, the rise of which is not positive for Asian or emerging market equities, says Joseph Lai, chief investment officer at Ox Capital Management.

He says: “When the US tightens, it is difficult for the rest of the world not to tighten, if the economies want to maintain currency stability against the USD.

"However, it is likely that the bulk of the rapid interest rate rises is behind us. It is likely that we will see better times ahead.”

When it comes to emerging Asia, James Syme, senior fund manager at JO Hambro Capital Management, says the US dollar’s effect on emerging market equity returns should not be underestimated or overlooked.

“At some point, global financial and economic conditions will see a weaker US dollar, with associated capital flows into the rest of the world. That is likely to see very strong returns across the emerging market equity landscape, including in emerging Asia.”

Jorry Nøddekær, fund manager at Polar Capital’s Asian Stars, likewise identifies a US recession as a concern of the market.

“As we read it, the market does want some form of mild recession, such that we can ‘kill’ the inflation. But we want a recession where the consumer survives relatively well.

“The dream-case scenario for Asian equities, with its strong growth bias, is that we get a very mild recession in the US, such that Asian companies’ revenue lines are minimally impacted, outside some very heavy export-driven companies with limited pricing power; but we get inflation down, and the US dollar down.”

There are always countries that we like from a top-down perspective

One of the attractions of managing an Asian equity fund, however, is the range of countries that can be invested in, says Jupiter Asian Income fund manager, Sam Konrad.

“From developed economies such as Australia and Singapore to emerging economies such as India and Indonesia, there are always countries that we like from a top-down perspective, whatever the macro challenges the world or some economies in the region may be facing.”

So, what are some of the other countries in Asia that managers think investors should also consider?

Japan

“In Japan companies like Nexon, a games provider heavily exposed to the Chinese market, and Fast Retailing, the owner of clothing brand Uniqlo, stand to benefit strongly from a Chinese reopening,” says David Raper, portfolio manager at Comgest, who adds that both experienced share price jumps the day after several Chinese cities eased Covid rules.

Turning to the country’s currency, Nomura Asset Management's chief investment officer Yuichi Murao says: “The yen’s rapid depreciation has discouraged global investors from venturing into the Japanese equity market, which has nevertheless registered a positive one-year return in local currency terms (as of November 30) but also poor results in US dollar terms.

“However, the Japanese equity market could become one of the most attractive asset classes in 2023, with the economy likely showing positive GDP growth as the domestic economy finally achieves a delayed post-pandemic recovery.

"Reopening the borders also allows inbound tourists to take advantage of a historically cheap yen.”

|

Why did the yen depreciate in 2022? |

|

“A rapid and substantial weakening of the Japanese yen this year has sent the currency to historical lows, not seen since the 1970s in real effective exchange rate terms,” says Nomura AM's Murao. “One major cause has been the widening interest rate differential. The Bank of Japan has maintained its commitment to ultra-loose monetary policy, including yield curve control, in its effort to revitalise the economy by ending the deflationary mindset of Japan’s private sector. “Monetary authorities elsewhere, led by the Federal Reserve, have raised interest rates to address persistent inflation.” |

Vietnam

Vietnam is following in China’s footsteps in its economic rise, says Cortesi at GAM. “The process is very similar to how China has grown in the past 30 years. As a key beneficiary of supply chain relocation, Vietnam enjoys a positive long-term outlook.”

Raper at Comgest also cites attractive growth opportunities in Vietnam. “The country has a young and vibrant workforce, and is benefitting from the shift of supply chains outside of China. Consumers in Vietnam should continue to benefit from the strong economic growth.”

Young people account for a large share of Vietnam’s labour force, with nearly half (49.5 per cent) aged between 15 and 39-years-old

Although he says Vietnam represents one of the best long-term structural growth stories going, Leiper at Titan adds: “We adopt a top-down global macro view, investing across asset classes and regions.

"We currently retain a positive outlook for Chinese equities given attractive valuations, extreme investor positioning, divergent monetary and fiscal policy relative to the rest of the world and diminishing zero-Covid policy headwinds.

“As such, and given our medium-term horizon, this may not be the right time to enter Vietnamese equities specifically, or frontier markets in general.”

India

“We see India as an economy relatively insulated from disappointing Chinese or global growth, and as a beneficiary of global companies looking to diversify their manufacturing away from China – a trend that has already started and is likely to continue for many years to come,” says Konrad at Jupiter.

Cortesi at GAM agrees Indian manufacturing is benefiting from companies adopting a ‘China plus one’ or ‘China plus two’ strategy. “The demographics and low labour cost also bode well for India’s long-term growth.

“However, following its tremendous outperformance over northern Asian markets such as China and Korea, Indian stocks currently look expensive relative to other Asian markets. This could limit the upside of Indian stocks next year.”

When it comes to the country’s short run prospects, outperformance by India’s equity markets, when compared with much of Asia, as well as the valuation differentials with other markets, is the “only issue” for Robert Horrocks, chief investment officer at Matthews Asia.

But, he adds that India looks set to maintain perhaps the fastest growth rates of all the major economies in which the firm invests.

Korea

A number of countries are developing industries around the demand for renewables, electric vehicles and hardware technology, says Monson at Nikko. “This is also true on a more stock-specific level in both Korea and Taiwan.”

Cortesi likewise says Korean stocks look interesting. “Interest rates in Korea are likely to peak next year, and could potentially even start falling. This should support Korean stocks, especially with valuations near historical lows.”

TEMIT lead portfolio manager Chetan Sehgal also cites opportunities tied to the recovery in South Korea, especially in key export areas.

“The backdrop of large US rate hikes, slowing global growth leading to recession concerns, and elevated oil prices have led to severe weakness in South Korea’s currency.

“However, a weaker won is a tailwind for South Korean exporters, as it enhances their competitiveness relative to peers, which we think leads to meaningful bottom-up stock-picking opportunities.

“As we look into 2023, a normalisation of interest rates and improvements in global growth could be positive for the South Korean stock market, which was impacted by a cyclical slowdown and higher energy prices.”

The US and Europe are slowing sharply and the major Asian emerging market economies are expected to account for close to three-quarters of global GDP growth in 2023

In more general terms, there is also optimism for the region as a whole next year.

While Leiper at Titan says he has a fairly pessimistic outlook for 2023, he adds: “It’s not all doom and gloom. One relative bright spot is Asia, which is expected to drive global economic growth next year versus the US and Europe, where we forecast recession.”

Konrad at Jupiter is similarly optimistic. “Asia enjoyed economic growth rates higher than any other region in the world in 2022, and we expect that to continue in 2023.

“Economic growth does not always equate to positive returns for equity investors however, which is why picking the right stocks in the right sectors is as vital as ever.”

Chloe Cheung is a senior features writer at FTAdviser

Outlook 2023, China: Will zero-Covid loosening provide a spark?

As unrest in China over Covid restrictions grows, our experts look at what could be in store for the Chinese economy, equity and debt markets in 2023.

- We expect Chinese GDP growth to increase to 5 per cent in 2023 from 3 per cent in 2022, helped by infrastructure spending, a recovery in the housing sector and loosening Covid-19 restrictions.

- China equity markets look attractive in the short-term but could face headwinds from policy uncertainty over the medium term.

- A reversal in dollar strength should be supportive of China debt in 2023.

China’s economy

David Rees, senior emerging markets economist

We still expect China’s economy to stage a recovery in 2023.

Admittedly, the outlook for exports, which have been the key driver of growth over the past couple of years, is challenging.

Indeed, we think exports are likely to contract in 2023. This is because we expect many developed market economies to fall into recession as high inflation and interest rates choke off demand.

The expected slump in exports puts the onus on domestic demand to drive any recovery and there are clearly still vulnerabilities here.

A combination of the government’s zero-Covid policy and collapse in activity in the real estate sector have weighed on domestic output and hit consumer confidence hard.

However, there are reasons to think there will be some improvement.

Infrastructure spending has been buoyant in 2022 and should underpin growth for a while longer as policy remains supportive.

Meanwhile, housing indicators may have started to find a floor and could stage some recovery in 2023 from a very low base.

And the service sector would clearly benefit from any loosening of Covid restrictions that may emerge during the course of the year.

This would help to unleash the cyclical recovery that leading indicators have been suggesting for a while will get underway in earnest as we head into 2023.

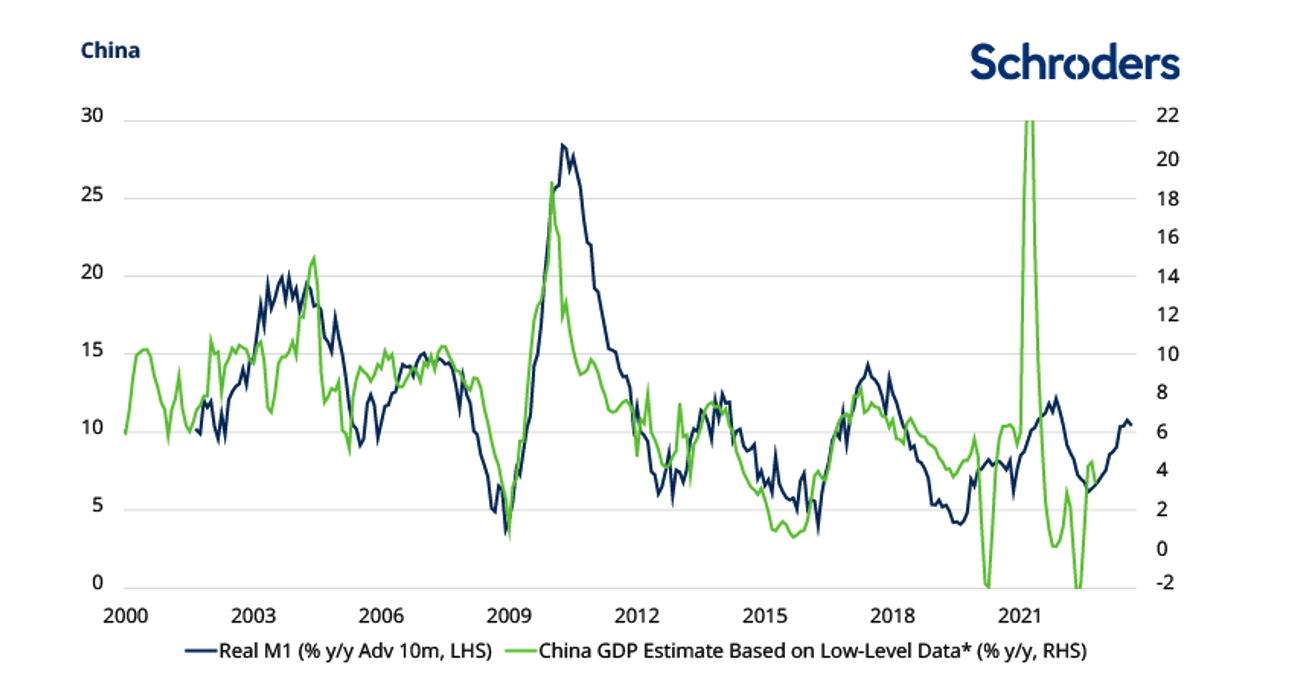

Chart 1: Recovery in China GDP expected in 2023

Source: Schroders, Refinitiv Datastream

The upshot is that our base case remains for GDP growth to pick up, from an expected 3 per cent in 2022 to around 5 per cent in 2023.

This would be a bit better than is generally expected given how downtrodden expectations have become.

The problem for markets is that, following the National Congress in October, politics rather than economics have been in the driving seat for sentiment.

And even though we expect the economy to stage a cyclical recovery in the near term, the long-term outlook is challenging.

China equity markets

Louisa Lo, deputy head Asia ex-Japan equities

China equity markets will likely continue to be influenced by the global macroeconomic backdrop, particularly the extent of future rate hikes and whether the US and EU experience soft or hard landings in terms of their economic slowdowns.

A peak in the US interest rate cycle could take the heat out of the US dollar, which should help liquidity in emerging market economies.

Growth and equity markets to remain volatile

Domestically, we may have already seen the worst in terms of China’s zero-Covid policy, with recent developments suggesting a gradual move away from the policy.

While a full reopening is unlikely, we expect to see more pragmatic implementation of Covid policies next year.

That said, a Covid exit wave remains a risk and as a result, economic growth momentum could remain somewhat volatile.

The government has recently become more supportive of the property sector, rolling out a set of measures to boost developer financing in November 2022.

These should go some way to helping stem the negative sentiment-spiral currently being experienced and may signal that the worst of the property tightening cycle is over.

However, it will likely still take some time for the sector to more fully recover given the softer economic backdrop and perhaps, more importantly, for investors to become comfortable that systemic risks are declining. We remain selective in terms of our investments in this space.

US-China tensions and geopolitics will likely continue to drive volatility in Chinese equity markets.

Recent announcements like the US CHIPS and Science Act, which will see major investment in research and development of semiconductors in the US, highlight the real impact that geopolitics can have on industries in China.

Supply chain safety and self-sufficiency will remain a key priority for the government going forward in our view.

As such, we expect to see an acceleration in investments into areas of strategic importance like technology, military, and supply chain independence. We also anticipate that de-globalisation trends will continue.

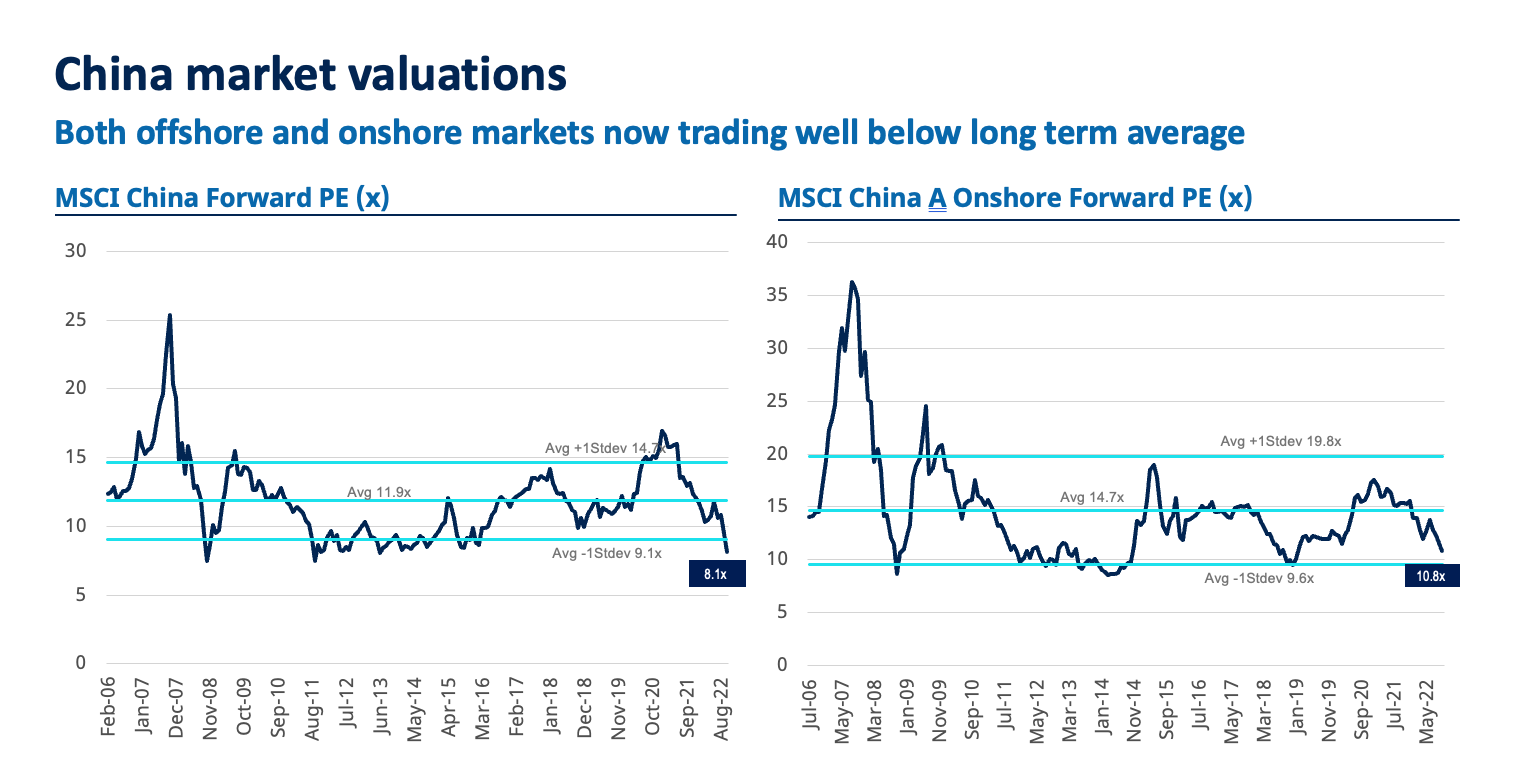

With Chinese equity markets trading at more than one standard deviation below long-term valuation levels, the market’s risk-reward profile looks reasonably attractive in the short term.

The chart below shows valuations on a forward price-earnings (PE) basis for both the offshore and onshore Chinese equity markets. A forward PE is a company’s price divided by the earnings per share for the next 12 months.

Source: Factset, as at October 31 2022

Indeed, markets could rebound sharply if we continue to see signs of an economic reopening and/or a gradual move away from zero-Covid, or further efforts to support the property market.

That said, increased investor uncertainty around policy execution and the government’s stance on private business and shareholder returns may present a stronger headwind for Chinese equity markets over the medium term.

We favour sectors that run alongside policy priorities

We hold a fairly balanced investment positioning, favouring sectors that run alongside policy priorities.

IT and industrial names should benefit from supply chain localisation and industrial automation upgrading.

Meanwhile, renewable energy companies (solar and wind) can capture increasing investment into the environment and the focus on a greener China.

We also favour construction machinery, in anticipation of a pick-up in infrastructure spend, and consumer names and companies that may benefit from a reopening of the economy.

The healthcare sector is also becoming more attractive after significant corrections over the past year.

On the internet/e-commerce sector, we have become less negative given low valuations and improving earnings.

Top-line (revenue) growth should start to recover in 2023 as economic growth improves, but in contrast to the past where the sector traded at a significant valuation premium to the market, we would expect these companies to trade like consumer cyclical names.

That means they should be valued more or less in line with their earnings growth potential.

We continue to take a bottom-up approach to investing, with allocation between the offshore and onshore markets reflecting the opportunities we see at a company level.

While valuations in the offshore market currently look more attractive, onshore markets may be better supported over the medium to long term given the greater number of stocks that provide alpha opportunities.

China debt

Julia Ho, head of Asian macro and Asian bonds

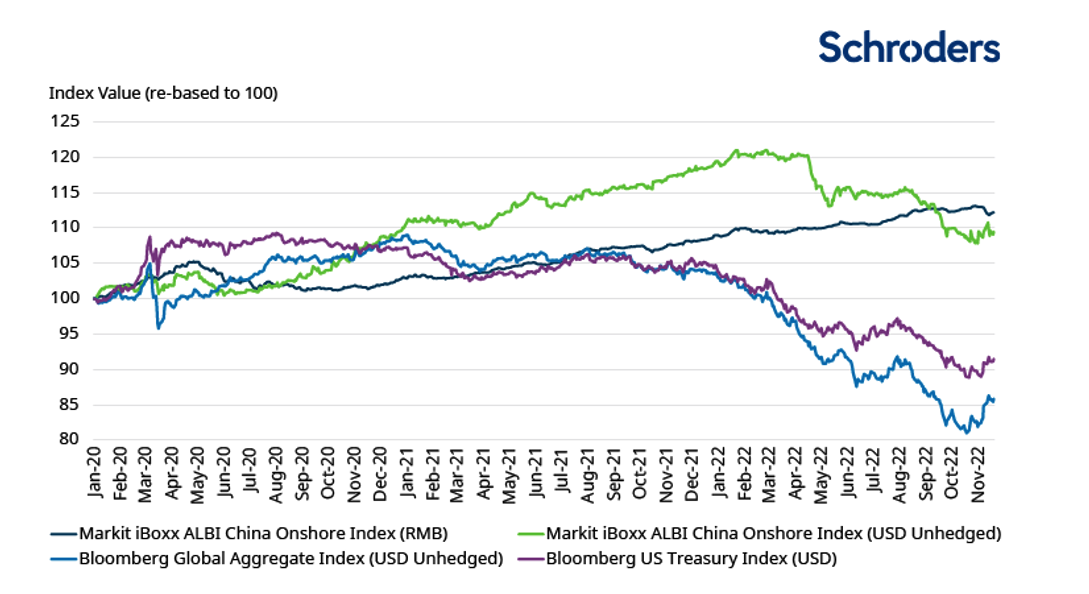

The outperformance of Chinese onshore bonds so far this year, as well as during the pandemic in March 2020 and in 2021, demonstrates the asset class’s resilience and diversification benefits.

Indeed, international investors increasingly perceive it as something of a 'safe haven'.

Chart 3: China bonds outperformance

Source: Schroders, Bloomberg

Going into 2023, the outlook for Chinese onshore bonds looks positive, especially if US dollar strength reverses.

The longer-term case remains compelling too.

The monetary policy backdrop is supportive. China’s capital markets are becoming increasingly accessible.

Meanwhile, Chinese bonds are increasingly being included in major global bond indices, bringing China into the investment universe for more international investors.

The internationalisation of the renminbi (as it increasingly becomes more of a global currency for trade, investment and foreign exchange reserves) is also supportive.

The low volatility and diversification benefits of the asset class also remain appealing.

We have recently upgraded our growth outlook for China following the recent spate of measures that have been implemented to support the property sector.

The authorities also appear to be gearing up a gradual re-opening of the economy in 2023 given recent moves to ease the country’s zero-Covid policy.

The relaxation of Covid curbs will likely focus primarily on reviving domestic demand, but the ensuing improved mobility within China should help consumer and business confidence to recover from current depressed levels.

That said, we caution that border reopening is likely to be slow and calibrated, and things might get worse before they get better, considering the potential rise in Covid cases and the onset of winter.

On a positive note, a slow normalisation of outbound tourism should help constrain the deterioration of China’s balance of payments position and stabilise the trade-weighted renminbi.

In terms of interest rates, our view is that Chinese government bond yields will likely be range-bound – that is, trading in a narrow range – and stable going into 2023.

This is because muted inflationary pressures with a modest pace of economic recovery mean that the People’s Bank of China should tend towards keeping monetary policy accommodative and liquidity ample.

Moreover, with the yield curve still positively sloped – that is, short-term bonds have a lower yield than longer-term bonds – exposure to Chinese bonds could be a good place to be for carry (or income), in our view.

Over the longer term we believe common prosperity, regulatory reform, ongoing deleveraging and the country’s ageing population are themes that are supportive of bond investments.

Protests in Beijing in November (Bloomberg/Fotoware)

Protests in Beijing in November (Bloomberg/Fotoware)

A housing complex in China's eastern Jiangsu province. (STR/AFP/Getty Images/Fotoware)

A housing complex in China's eastern Jiangsu province. (STR/AFP/Getty Images/Fotoware)

A solar panels factory in Jiangsu province. (Alex Plavevski/EPA-EFE/Shutterstock/Fotoware)

A solar panels factory in Jiangsu province. (Alex Plavevski/EPA-EFE/Shutterstock/Fotoware)

(Qilai Shen/Bloomberg/Fotoware)

(Qilai Shen/Bloomberg/Fotoware)